Construction equipment depreciation calculator

The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Based on experience we know that we can rent this machine for about 13500 per month.

Purchasing Construction Equipment Calculating The Return On Investment

This money either be borrowed from a lender or it will be taken.

. This concept is known as an assets estimated useful life. This means that we will get a depreciation value of 1716 per month by dividing the sale price 103000 by the remaining useful life 60 months. Calculating Depreciation Cycle Step 1 2.

In other words the depreciation rate in the first year will be 7 divided by 28 which equals 25. 1THE STRAIGHT LINE METHOD Annual depreciation. Based on Excel formulas for SLN costsalvagelife.

Calculate depreciation used for any period and create a straight line method depreciation schedule. Calculate the annual depreciation and calculate the book value of the asset after each year. Ad Submit accurate estimates up to 10x faster with Houzz Pro takeoff software.

7 6 5 4 3 2 1 28. These construction calculators are quick and simple to use in Excel or Google Sheets. Identify the Retail Rental Rate.

Calculator Savings Asset Value Amount Initial cost of asset Salvage Value of the Asset Useful Life Years Result Amount. This paper analyzes methods of depreciation expenses calculation as well as their impact on the overall expanses of construction machinery and the impact on the cost per unit of material. There are many variables which can affect an items life expectancy that should be taken into consideration when determining actual cash value.

Builders save time and money by estimating with Houzz Pro takeoff software. In this article well take a look at the definition of asset useful life why its important. Box 1 shows the beginning of the cycle.

Also includes a specialized real estate property calculator. Some items may devalue more rapidly due to consumer preferences or technological advancements. The calculator should be used as a general guide only.

Up to 24 cash back The purchase of construction equipment requires a significant investment of money. This collection of free construction calculators was created by the team at BuildBook as a quick and easy way for home builders and remodelers to calculate construction costs labor costs equipment depreciation marketing ROI and so much more. We do work we put completed construction in place.

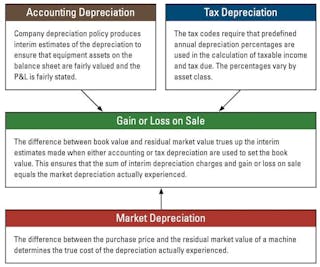

Lets turn to the diagram and develop a simple pragmatic understanding of a how depreciation works. Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. It costs money to do this work box 2 which includes labor materials subcontractors indirects and of course equipment box 3.

Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of depreciation of that asset or piece of equipment. Facility equipment wont last forever so its important for facility managers to determine the average number of years an asset will be useful before its value is fully depreciated. The Hourly Depreciation is the depreciation cost in respect of new machines chargeable to the work on hourly basis is calculated using Hourly depreciation 09 Book Value Life SpanTo calculate Hourly Depreciation you need Book Value C bv Life Span L sWith our tool you need to enter the respective value for Book Value Life Span and hit the calculate button.

Next youll divide each years digit by the sum.

Macrs Depreciation Calculator Based On Irs Publication 946

Depreciation Of Building Definition Examples How To Calculate

:max_bytes(150000):strip_icc():gifv()/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

3 Calculation Of Machine Rates

Declining Balance Depreciation Calculator

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Calculate Depreciation Expense

Time To Rethink The Equipment Rate Calculation Construction Equipment

Depreciation Calculator Definition Formula

Double Declining Balance Depreciation Guru

Math You 4 4 Depreciation Page 191

Cost Of Construction Equipment How Do You Calculate Construction Equipment Costs Lceted Lceted Institute For Civil Engineers

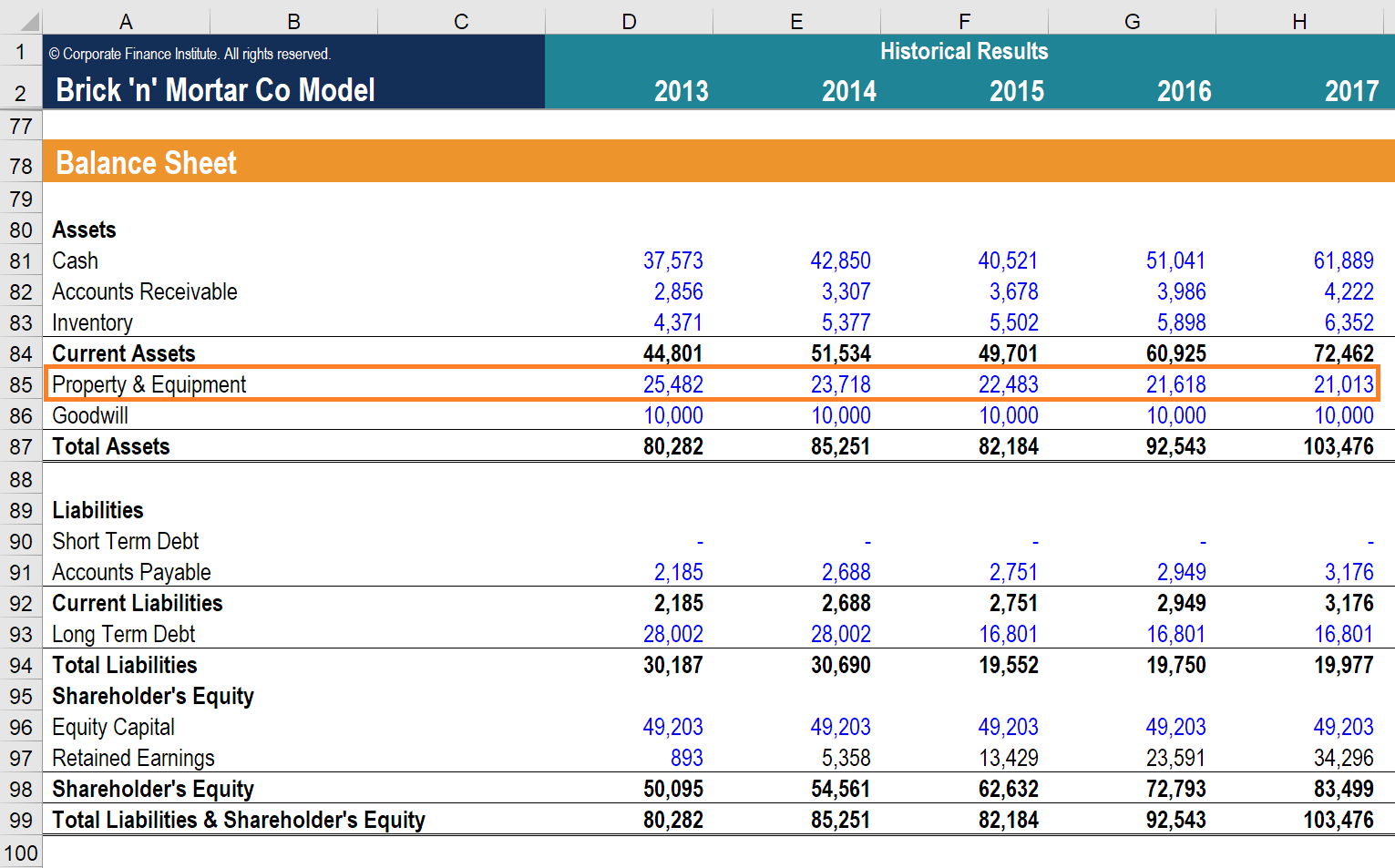

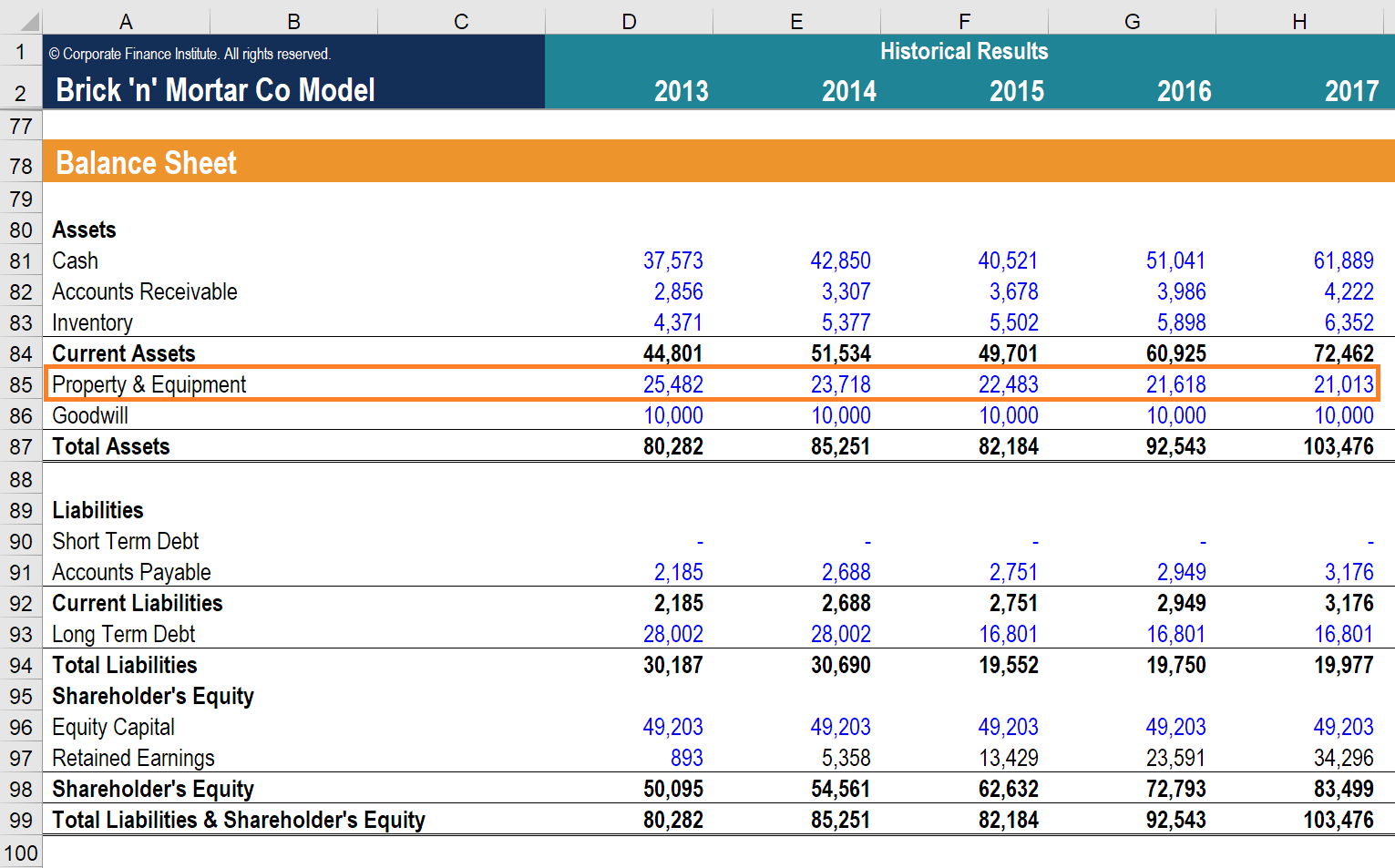

Pp E Property Plant Equipment Overview Formula Examples

Pdf Methods Of Calculating Depreciation Expenses Of Construction Machinery

Three Types Of Asset Depreciation Construction Equipment

Depreciation Schedule Formula And Calculator Excel Template

Method To Get Straight Line Depreciation Formula Bench Accounting